Income Tax Department

RITA (Regional Income Tax Agency) will collect and handle all accounts as of July 1, 2022. Please call them at 800-860-7482 for all income tax questions relating to 2019 and up tax years. If you have an older account that has been turned over to the Attorney General of Ohio for collections, please contact the Attorney General’s office for assistance.

Minerva Welcome Letter – FINAL

The Regional Income Tax Agency (RITA) mailed Administrative Subpoena letters to taxpayers that did not respond to the Non-Filing Income Tax Notice that was sent before the Subpoena was issued. Taxpayers can simply send RITA the documents listed on the letter via:

e-file returns or exemptions at:

https://www.ritaohio.com/Individuals/Home/File

Mail:

RITA

Attn: Compliance Department 198

Regional Income Tax Agency

PO BOX 470538

Broadview Heights, OH 44147-0538

Fax

440-922-3510

More details about Administrative Subpoena’s can be found at https://www.ritaohio.com/Individuals/Home/SubpoenaNotice

All forms are available for download (on the right of this page). Please see “Tax Forms”.

The Regional Income Tax Agency (RITA) mailed non-filer letters to taxpayers that neglected to file a municipal income tax return. Taxpayers can simply send RITA the documents listed on the non-filing letter via:

e-file returns or exemptions at:

https://www.ritaohio.com/Individuals/Home/File

Mail:

RITA

Attn: Compliance Department 198

Regional Income Tax Agency

PO BOX 470538

Broadview Heights, OH 44147-0538

Fax

440-922-3510

More details about Non-Filing Notices can be found at https://www.ritaohio.com/Individuals/Home/NonFilingNotice

Taxpayers’ Rights and Responsibilities

“Taxpayers’ Rights and Responsibilities” means the rights provided to taxpayers in sections 718.11, 718.12, 718.19, 718.36, 718.37, 5717.011, and 5717.03 of the Ohio Revised Code and any corresponding ordinances of the Municipality, and the responsibilities of taxpayers to file, report, withhold, remit, and pay municipal income tax and otherwise comply with Chapter 718 of the Ohio Revised Code and resolutions, ordinances, and rules adopted by a municipal corporation for the imposition and administration of a municipal income tax.

VILLAGE OF MINERVA INCOME TAX DEPARTMENT – GENERAL TAX INFORMATION

The Village of Minerva Income Tax Department administrates the village’s income tax law. Income tax revenues are the village’s largest source of revenue for financing the operations of the village.

WHO NEEDS TO FILE:

- Residents 18 years of age or older, mandatory filing is required for all qualifying income.

- Non residents 18 years of age or older and have qualifying income within the Village of Minerva and Minerva income taxes have not been paid or withheld.

- If you own and/or operate a business in Minerva.

- If you earn qualifying income from a business or pass-through entity for work done or services performed within Minerva.

- If you own rental property within Minerva

– Income Tax Rate: 1.5%

-Tax Credit: 100% credit of taxes paid to other municipalities for Minerva residents who work outside the village and pay taxes to other municipalities.

-Estimated Tax Payments: Every taxpayer shall make a declaration of estimated taxes for the current year if the amount payable as estimated taxes is at least $200.00.

PENALTY AND INTEREST: https://www.irs.gov/pub/irs-drop/rr-22-12.pdf

Interest will be calculated at the July federal short-term interest rate of 0.18% plus 5%

Calendar Year Monthly Interest Rate Yearly Interest rate

2023 0.58% 7.00%

2022 0.42% 5.00%

2021 0.42% 5.00%

2020 0.58% 7.00%

2019 0.58% 7.00%

2018 0.50% 6.00%

2017 0.50% 6.00%

2016 0.42% 5.00%

Income Tax Administrator

Income Tax Administrator

Please contact Regional Income Tax Agency at 800-860-7482

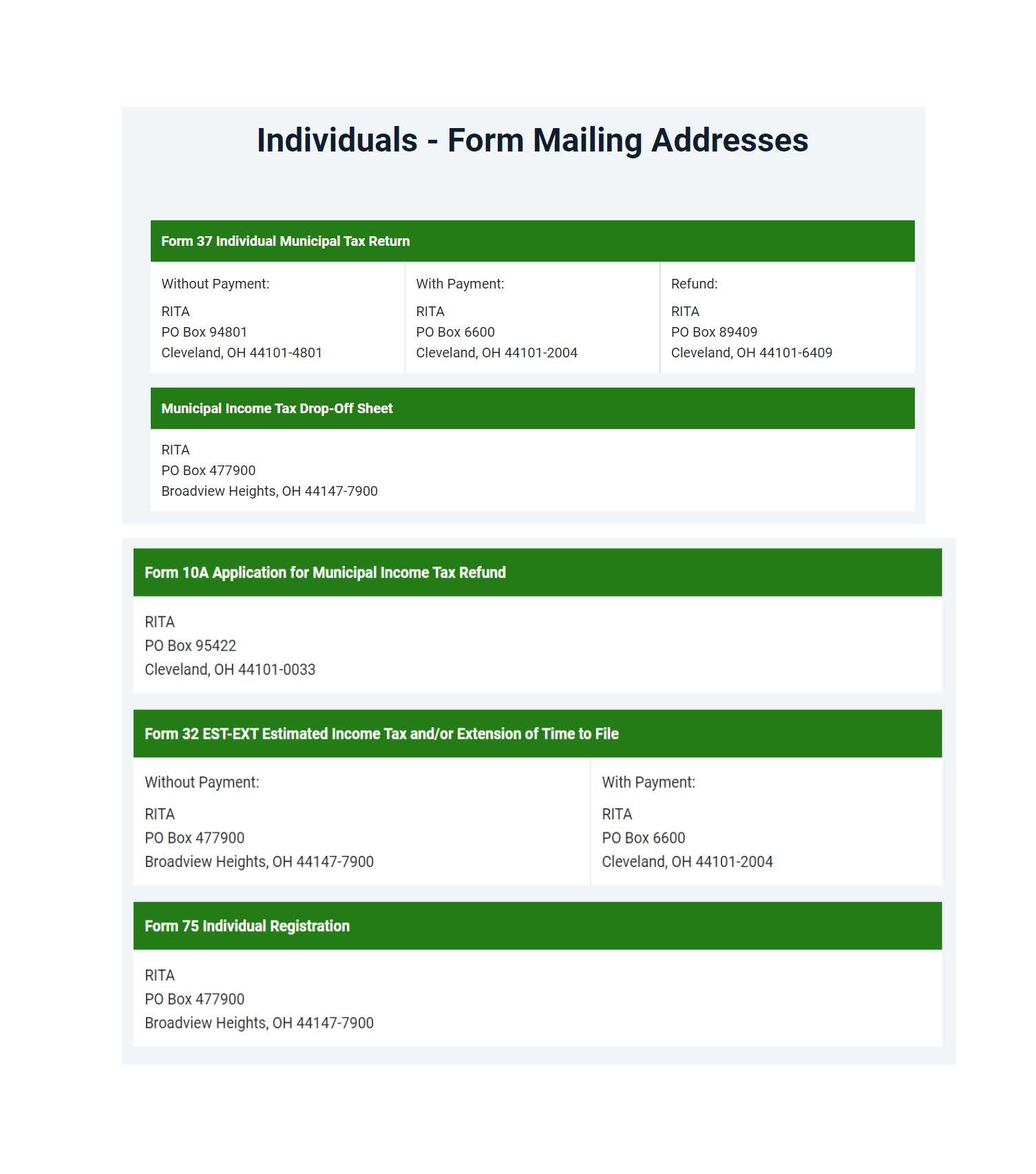

Individual Municipal Tax Drop Off Sheet

Please use this form if you wish to mail your documents in to the Regional Income Tax Agency to have them complete your taxes for you. Please note that you will not receive your original documents back.